Ավանդ “Ընտանեկան կապիտալ”

Deposit “Family capital”

MINIMUM AMOUNT

100,000 AMD

TERM

6570 days

ANNUAL INTEREST RATE

9,5%

Summary information |

|||||||||

Main terms of the deposit |

|||||||||

|

Deposit validity |

01.06.18 – not set |

||||||||

|

Deposit currency |

AMD |

||||||||

|

Minimum deposit amount |

100,000 |

||||||||

|

Term of the deposit |

Interest payment procedure |

Annual interest rate |

|||||||

|

Maximum 6570 days (18 years ) |

At the end of the term |

9.5% |

|||||||

|

Maximum deposit amount |

100,000,000 |

||||||||

|

Type of the deposit |

|

||||||||

|

Possibility to replenish money- yes Capitalizing interest is not permitted. |

|||||||||

|

Possibility of partial withdrawal- yes, but only for the following purposes: 1. to pay off a child's parent’s or legal guardian’s a mortgage loan 2. to pay the fee of an educational institution accredited in the Republic of Armenia /child’s family member / 3. for a child's family member's health insurance payment. |

|||||||||

|

The deposit can be fully withdrawn upon a written request of the RA Ministry of Labor and Social Affairs. |

|||||||||

|

All the depositors are receiving a UNIPAY, unified system of utility payments card as a gift. |

|||||||||

ADDITIONAL INFORMATION

Tariffs and penalties

1. The term deposit account is serviced through bank accounts. If the customer does not hold a bank account in Unibank OJSC, the Bank opens an AMD bank account for the depositor making term deposits in AMD, while in case of foreign currency term deposits, besides the foreign currency bank account, an AMD bank account is also opened.

2. There is no maintenance fee charged for opening an account to receive money from the family capital.

Deposit account statements and their copies are provided free of charge with no time limit. The Bank is entitled to unilaterally close the customer's bank account if the customer has not provided the service fees set by the Bank tariffs, the non-decreasing balance and/or has not made transactions for over a year.

3. In case of premature termination of a bank deposit agreement on the depositor’s initiative:

a) the paid interest is deducted from the deposit amount, if the term deposit agreement stipulates a monthly interest payment,

b/ interest is recalculated at the rate of demand deposit set by the bank for the actual period of funds being on deposit.

4. The bank deposit agreement can be prolonged on terms specified by the deposit agreement. If the depositor does not require to pay the deposit amount after the expiration of the deposit or to extend it in accordance with the terms of the agreement, then the term deposit is considered extended in accordance with the terms of the demand deposit set by teh bank.

The Bank is entitled to alter the interest rates calculated on the bank account balance in accordance with the tariffs aaproved by the Executive Board of Unibank OJSC unless otherwise provided by the bank account agreement.

5. Money received from the third parties may also be credited to the depositor's account in the name of the Depositor, indicating the necessary data about their deposit account.

6. The interest on the funds in the deposit account is calculated on the basis of the Nominal interest rate.

7. The annual percentage yield shows the percentage that the depositor will receive for a 1000 USD deposit for a 365-day period through the application of a simple annual interest rate, and as a result of the frequency of compounding and payment of interest.

ATTENTION: THE INTEREST RATES ON THE AVAILABLE BALANCE OF YOUR ACCOUNT ARE CALCULATED ON THE BASIS OF THE NOMINAL INTEREST RATE. THE ANNUAL PERCENTAGE YIELD SHOWS HOW MUCH PROFIT YOU WOULD HAVE MADE IF YOU HAD DONE ALL THE MANDATORY PAYMENTS RELATED TO THE DEPOSIT AND AS A RESULT OF RECEIVING INTEREST RATES ESTABLISHED PERIODICALLY. SEE THE FORMULA FOR CALCULATING THE ANNUAL INTEREST RATE BELOW.

Information on interest rates

1. Annual simple interest is an annual interest rate set by the deposit agreement, on the basis of which the bank calculates the interest to be paid to the depositor.

The formula for calculating the interests paid under this type of deposit agreement:

DA * I / 365 * Days – 10% (income tax), where

DA – deposit amount placed

I –annual simple interest rate

Days – number of days for which the deposit is placed, taking into account RA Civil Code article 907, paragraph 1 which defines that interest on the deposit amount is not calculated for the days of return to the depositor or withdrawal from the depositor's account for other grounds.

Example 1

Term of the deposit - 365 days

Principal amount of the deposit - 100 000 AMD

Annual simple interest rate - 9.5 %

100 000 *9.5 /100 / 365 * 364 -10% = 8 526.6 AMD

2. Annual percentage yield (APY) shows how much the annual interest rate of the deposit will be as a result of the customer making mandatory payments related to the deposit and adding the received interest to the principal amount (compounding).

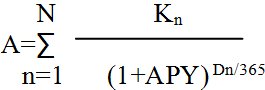

, where

, where

A - Principal amount of the deposit,

n- next cash flow number for the deposits

N- is the last number of the cash flow for the deposits (including the cash flow at the time of making the deposit), after which the term of the deposit contract is considered completed

Kn - Flows of the deposit and/or compound interests, as well as mandatory payment flows (if any) at the time of making the deposit and/or during its validity.

Dn –shows the number of days passed from the day of making the deposit until the next (nth) cash flows for the deposit, included. In case the cash flow coincides with making the deposit- D 1=0:

APY is the annual percentage yield.

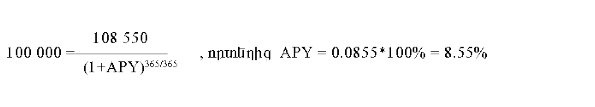

- Let’s suppose a deposit with the following conditions is offered:

a. Deposit amount: 100 000 AMD

b. Term of the deposit: 1 year (365 days)

c. Annual simple interest: 9.5 %

d. Interest payments at the end of the deposit term

e. Mandatory payments made by the depositor on the day of getting the deposit:

The interest paid at the end of the deposit agreement is:

100 000 * 0.095-10%=8 550 AMD

n=1

D=365

K= 108 550

3. Possible calculation of annual interest rate on deposits in case of regular frequency of interest payments

APY= (1+r/n)n- 1, where

APY is the annual percentage yield

r-annual simple interest rate

n- number of compounding periods per year

If the frequency of making interest payments equals to n =1 at the end of the term, then

APY= (1+0.095/1)1 -1,

APY=0.095*100=9.5%

Information on protection of the depositor’s rights

All the disputes or disagreement arising during the account maintenance or deposit activity period are settled by the mutual consent of the two parties. In case of a failure to reach an agreement, the depositor’s rights are protected in a legal form, as well as through the financial system mediator. The depositor can protect their rights either personally or through an authorized representative.

The Bank is not entitled to condition the conclusion of a deposit agreement by the conclusion of an arbitration one.

Additional information

1. The necessary documents for making deposits are:

- passport or identity document,

- public service number or reference on refusing it.

2 The interest on the time deposit amount is accrued from the day the Bank receives the deposit until the day before it is returned to the depositor or written off from the Depositor's deposit account on other grounds. Interests are accrued on a daily basis. In accordance with the law “On currency regulation and currency control” Article 6, point 2 interest payments on financial operations are made in drams of the Republic of Armenia. If the deposit is made in a foreign currency, the interest is paid at the settlement rate set by the CBA on the day of payment.

3. Interest accrued to the deposit is subject to taxation (income tax) at the rate of 10%, according to the legislation of RA. The depositor is paid the amount after taxes.

4. If the deposit maturity term coincides with a holiday and/or weekends, the term is the next working day.

5. The deposits placed in the Bank are guaranteed by the Individuals’ Deposit Guarantee Fund, in accordance with the legislation of RA. The guaranteed deposit limits are as follows:

a) In case of only an AMD deposit- 16 million AMD, instead of the previous 10 million AMD.

b) In case of only a foreign currency deposit – 7 million AMD, instead of the previous 5 million AMD.

c) if you have both an AMD and foreign deposits in an insolvent bank, and the sum of the AMD deposit is over 7 million AMD, only that deposit is guaranteed for up to 16 million Armenian drams.

d) if you have both an AMD and foreign deposits in an insolvent bank and the sum of the AMD deposit is less than 7 million AMD, the deposit in AMD is fully guaranteed, while the deposit in a foreign currency is guaranteed at the amount of 7 million AMD and reimbursed dram-denominated bank deposit.

6. You can get further information by calling the hotline at (+37410) 59 55 55.

«For the purpose of proper examination of the client defined by the RA law “On Combating Money Laundering and Terrorist Financing", the consumer may be requested to submit additional documents or other information, as well as be asked additional questions during oral communication, based on the “Know your customer” principle.Տեղեկատու կենտրոն` +37410 59 55 55

“Your Financial informant”- www.fininfo.am

“Your Financial informant”- www.fininfo.am

ATTENTION: “YOUR FINANCIAL INFORMANT” IS AN ELECTRONIC SYSTEM WHICH MAKES IT EASY TO SEARCH, COMPARE, AND SELECT THE MOST EFFECTIVE OPTION FOR SERVICES OFFERED TO INDIVIDUALS.