Փոխարժեքներ

- Գնում Վաճառք

- USD

- 380.00

- 385.00

- EUR

- 442.00

- 456.00

- RUB

- 4.70

- 5.05

- GBP

- 506.00

- 525.00

| USD | EUR | RUB | GBP | |

| Կանխիկի մուտքագրման % | - | - | - | 3 |

- USD

- 379.00

- 384.00

- EUR

- 442.00

- 456.00

- RUB

- 4.70

- 5.05

- GBP

- 506.00

- 525.00

- CHF

- 475.00

- 492.00

- CNY

- 53.50

- 55.40

- AED

- 102.15

- 106.20

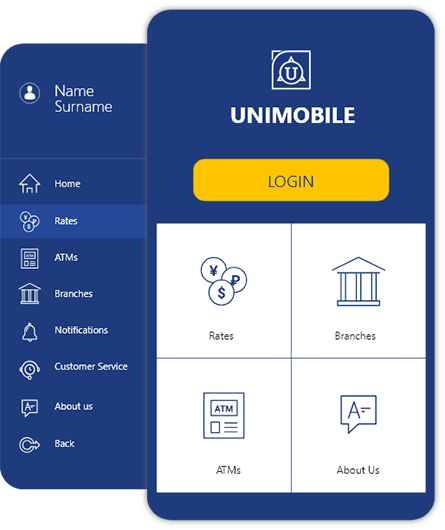

Ամենապահանջված ծառայությունները

Փոխարժեքներ

- Գնում Վաճառք

- USD

- 380.00

- 385.00

- EUR

- 442.00

- 456.00

- RUB

- 4.70

- 5.05

- GBP

- 506.00

- 525.00

| USD | EUR | RUB | GBP | |

| Կանխիկի մուտքագրման % | - | - | - | 3 |

- USD

- 379.00

- 384.00

- EUR

- 442.00

- 456.00

- RUB

- 4.70

- 5.05

- GBP

- 506.00

- 525.00

- CHF

- 475.00

- 492.00

- CNY

- 53.50

- 55.40

- AED

- 102.15

- 106.20

ՄԵՐ ՁԵՌՔԲԵՐՈՒՄՆԵՐԸ

ԲԱՆԿԸ ՁԵՐ ՀԵՌԱԽՈՍՈՒՄ

ՆՈՐՈՒԹՅՈՒՆՆԵՐ